SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

![[MISSING IMAGE: lg_phillips66.jpg]](https://capedge.com/proxy/PRE 14A/0001144204-18-014335/lg_phillips66.jpg)

, 2018

Safety. Honor. Commitment. These are the values that guide how the 14,80014,600 employees of Phillips 66 conduct business every day as they work to fulfill our mission to provide energy and improve lives. We are also guided by our four pillars of sustainability: operational excellence,with record setting and industry leading safety and environmental commitment, social responsibility and economic performance.

Our commitment to shareholder engagement. We value the perspectives our shareholders provide by participating at our annual meeting and engaging in conversations with us throughout the year. In 2016,2017, we invitedmet with shareholders representing approximatelynearly half of our shares outstanding to discuss governance, compensation and other topics of interest to our shareholders. In response, shareholdersoutstanding. We were provided valuable feedback that was shared with the full Board, which considered that feedback in its decision making process.Board. As a result of these discussions, management is resubmitting a proposal asking shareholders to declassify the Board adopted aso that our directors will be elected annually. For additional information regarding the feedback we heard through our engagement efforts and actions taken in response, please refer to SHAREHOLDER AND COMMUNITY ENGAGEMENT of the attached proxy access bylaw earlier this year. The valuable input we receive from shareholders is very important to the Board and we look forward to continuing our dialogue in the coming year.

Growing shareholder distributions. We understand the importance of growing shareholder distributions in the form of share repurchases and dividends. In 2016, we increased the dividend by 13 percent and returned $2.3 billion of capital to shareholders through dividends and share repurchases.

statement.

We.

Sincerely,

Chairman of the Board and

Chief Executive Officer

|  |

![[MISSING IMAGE: ph_greg-garland03.jpg]](https://capedge.com/proxy/PRE 14A/0001144204-18-014335/ph_greg-garland03.jpg)

|

Phillips 66 supports educational programs that contributeFounded in 1917 as the Roxana Petroleum Company, the plant on the banks of the Mississippi River helped give rise to the vibrancytown itself. It also produced fuel for U.S. forces during World War II, winning accolades from the Army and resilience of communities. RecognizingNavy. Today, as a joint venture with Cenovus, the refinery has a more than $7 billion economic impact annually on the region, according to a study by Southern Illinois University at Edwardsville.

![[MISSING IMAGE: ph_wood-river.jpg]](https://capedge.com/proxy/PRE 14A/0001144204-18-014335/ph_wood-river.jpg)

One way we demonstrate that support is our participation with the MIND Research Institute, a nonprofit organization that develops visually based software to enhance learning and brings visual math instruction and game-based learning to local schools. MIND's signature ST Math program, game-based instructional software for K-12, is designed to boost math comprehension and proficiency through visual learning. With this program, we aim to instill a love of math in students and develop tomorrow's problem solvers.

Since 2014, Phillips 66 has contributed $2.5last 20 years, employees have given more than $5 million to the InstituteUnited Way alone. And last year, they used Phillips 66 Volunteer Grants to access more than $113,000 in funds for the organizations where they volunteer. The refinery’s most recent act of philanthropy: A playground for children of all abilities and sponsoreda nod to the ST Math programPhillips 66 values of safety, honor and commitment.

Among the children sitting in classrooms today are tomorrow's energy industry leaders. That's why Phillips 66 is investing in STEM education. We believe that this partnership will help us fuel students' interest in science, technology, engineering and math, while preparing them for the future.

![[MISSING IMAGE: lg_phillips66.jpg]](https://capedge.com/proxy/PRE 14A/0001144204-18-014335/lg_phillips66.jpg)

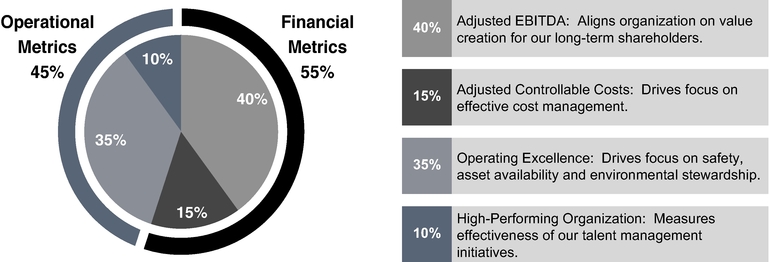

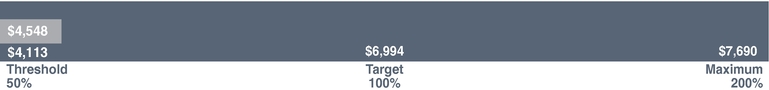

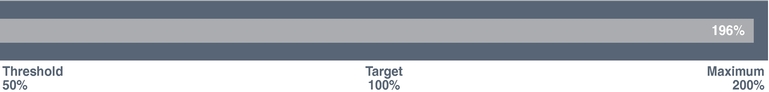

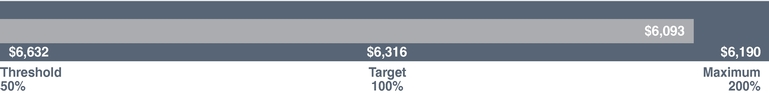

| NOTICE OF OF SHAREHOLDERS | |

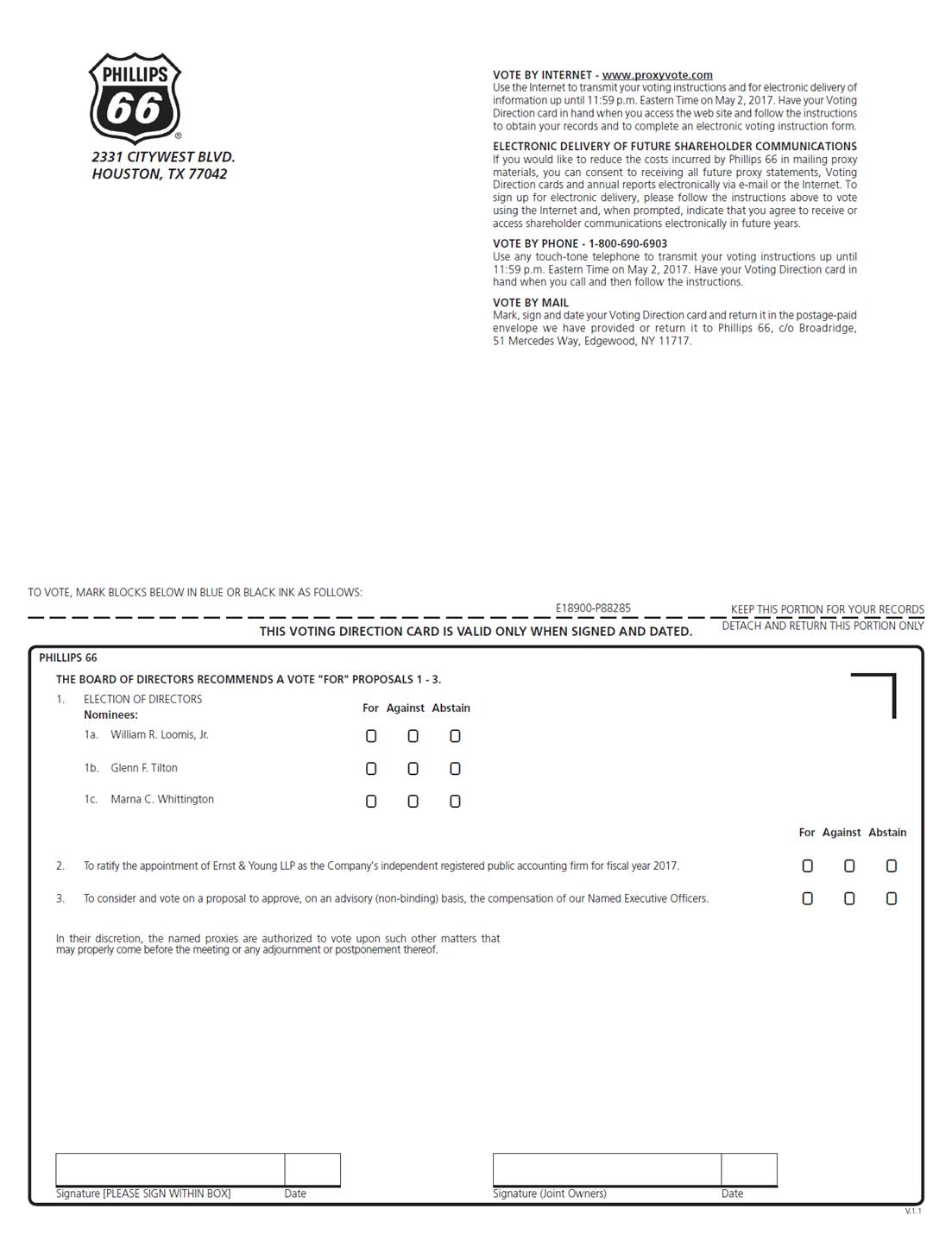

77024 You can vote if you were a shareholder of record on March 12, 2018. Shareholders as of the Record Date are invited to attend the annual meeting. Our following methods. 28, 2018. Code of Business Ethics and Conduct Other Benefits and Perquisites Your Company CODE OF BUSINESS ETHICS AND CONDUCT its development and implementation. In this oversight role, the Board of Directors is responsible for satisfying itself that the risk management processes designed and implemented by the Company’s management are functioning as intended, and that necessary steps are taken to foster a culture of risk-adjusted decision making throughout the organization. family NON-EMPLOYEE DIRECTOR COMPENSATION. The following Directors Whose Terms Expire at the 2019 Annual Meeting 2011. Audit Fees(1) Audit-Related Fees(2) Tax Fees(3) All Other Fees Total One or more representatives of Ernst & Young are expected to be present at the Annual Meeting. The representatives will have an opportunity to make a statement if they desire and will be available to respond to appropriate questions from 2017. This Compensation Discussion and Analysis details our executive compensation programs for The following table summarizes the principal elements of compensation programs. Name Greg Garland Robert Herman Paula Johnson Kevin Mitchell Tim Taylor All NEOs received base salary increases effective March 1, Variable Cash Incentive Program Based on actual Company performance, the Compensation Committee determined that a payout of Combined TRR Combined LWCR Process Safety Rate Environmental Events Asset Availability Combined Operating Excellence Adjusted Controllable Costs METRIC Adjusted EBITDA Operating Excellence Adjusted Controllable Costs High-Performing Organization Total Corporate Payout The Compensation Committee has the authority to adjust our NEOs’ individual VCIP payouts by +/–50 percent of the formula-based target payout. The Compensation Committee may apply an individual performance adjustment to reflect project-based accomplishments that drove or detracted from shareholder value or for market-based considerations to more closely align the payout with shareholder returns. This flexibility allows us to reflect our unique business strategy and portfolio of assets as well as differentiate individual executive performance. The Compensation Committee made adjustments to individual Greg Garland Robert Herman Paula Johnson Kevin Mitchell Tim Taylor Restricted Stock Units NAME Greg Garland Robert Herman Paula Johnson Kevin Mitchell Tim Taylor previously: Comprehensive Security Program Personal Use of Company Aircraft EXECUTIVE LEVEL will, in fact, be fully deductible. engagements, and 44 percent related to surety bonds. ” 2017. 2019. $4,087,219. Greg Garland Robert Herman Paula Johnson Kevin Mitchell Tim Taylor Greg Garland Robert Herman Paula Johnson Kevin Mitchell Tim Taylor 2017. Greg Garland Robert Herman Paula Johnson Kevin Mitchell Tim Taylor 2017 Greg Garland Robert Herman Paula Johnson Kevin Mitchell Tim Taylor 2017 The following table provides information on nonqualified deferred compensation as of December 31, Equity term. level. level. CICSP benefits consist of cash severance payments and acceleration of equity awards. Greg Garland Severance Payment Accelerated Equity(1) Life Insurance TOTAL Robert Herman Severance Payment Accelerated Equity(1) Life Insurance TOTAL Paula Johnson Severance Payment Accelerated Equity(1) Life Insurance TOTAL Kevin Mitchell Severance Payment Accelerated Equity(1) Life Insurance TOTAL Tim Taylor Severance Payment Accelerated Equity(1) Life Insurance TOTAL directors. Lead Director Audit and Finance Committee Human Resources and Compensation Committee All Other Committees The total annual cash compensation is payable in monthly cash installments. Directors may elect, on an annual basis, to receive all or part of their cash compensation in unrestricted stock or in RSUs (such unrestricted stock or RSUs are issued on the last business day of the month valued using the average of the high and low prices of Phillips 66 common stock as reported on the NYSE on such date), or to have the amount credited to the Other Compensation Gary K. Adams J. Brian Ferguson William R. Loomis, Jr. John E. Lowe Harold W. McGraw III Denise L. Ramos Glenn F. Tilton Victoria J. Tschinkel Marna C. Whittington Equity compensation plans approved by security holders Equity compensation plans not approved by security holders Total Mr. Garland Ms. Johnson Mr. Mitchell Mr. Taylor Mr. Herman Mr. Adams Mr. Ferguson Mr. Loomis Mr. Lowe Mr. McGraw(3) Ms. Ramos Mr. Tilton Ms. Tschinkel(4) Dr. Whittington Directors and Executive Officers as a Group (16 Persons) meeting. envelope. How do I vote if I hold my stock through a Phillips 66 employee benefit plan? envelope. 8, 2018. The contact information for our Corporate Secretary may be found under COMMUNICATIONS WITH OUR BOARD. meeting. 2018. What if I return my proxy but ” the proposal regarding the declassification of the Board of Directors. results of the shareholder vote. The policy also provides that inspectors of election must be independent and cannot be employees of the Company. Occasionally, shareholders provide written comments on their proxy card that may be forwarded to management. Net Income Plus: Provision for income taxes Net interest expense Depreciation and amortization (D&A) EBITDA Adjustments: EBITDA attributable to noncontrolling interests Proportional share of selected equity affiliates income taxes Proportional share of selected equity affiliates net interest Proportional share of selected equity affiliates D&A Impairments by equity affiliates Pending claims and settlements Equity affiliate ownership restructuring Recognition of deferred logistics commitments Railcar lease residual value deficiencies and related costs Certain tax impacts Adjusted EBITDA PSP ROCE Numerator Net Income After-tax interest expense GAAP ROCE earnings Adjustments* PSP ROCE earnings Denominator GAAP average capital employed** In-process capital Cash adjustment PSP average capital employed PSP ROCE (percent) GAAP ROCE (percent) Operating expenses Selling, general and administrative expenses Adjustments: Certain employee benefits Asset disposition impacts Foreign currency and utility price impacts Adjusted controllable costs 3, 2017

9, 2018 at 9:00 A.M. Central Daylight TimeMarriott WestchaseMemorial City2900 Briarpark Drive945 Gessner Road

Houston, Texas 77042

(281) 501-4300Directorsdirectors named in this proxy statement2.Company'sCompany’s independent registered public accounting firm for fiscal year 201720183.4.10, 2017.20162017 Annual Report to Shareholders accompanies, but is not part of, these proxy materials.Proxy VotingVote Right AwayShareholders as of the Record Date are invitedYour vote is very important to attend the annual meeting. Whether or notus and to our business. Even if you plan to attend our Annual Meeting in person, please vote in advanceright away using any of the meeting by using one of the methods described in this proxy statement. BY INTERNET USING YOUR COMPUTER BY TELEPHONE BY MAILING YOUR PROXY CARD ![]()

![]()

![]()

www.proxyvote.com

(800) 690-6903

and send by mail in the enclosed postage-paid envelope 22, 2017.

Corporate Secretary Page Page 3 86 868Summary of Board Committees 10Director Independence 10Shareholder and Community Engagement 10Sustainability 11Communications with the Board 11Director Meeting Attendance 12Board's Risk Oversight 12 6 6 8 8 11 13 Related Party Transactions 13Board and Committee Evaluations 14Nominating Processes of the Nominating and Governance Committee 14PROPOSAL 1:ELECTION OF DIRECTORS

15 16 17 2423 2625 25 26 27Peer Group Comparisons 29 30 37Executive Compensation Governance 39 41 4042 4244 43Summary Compensation Table 43Grants of Plan-Based Awards 45 45 47 4648 4749 4850 4951 50522017 PROXY STATEMENT 120172018 PROXY STATEMENTPage references are supplied to help you find further information in this proxy statement. Throughout the proxy statement, we may refer to Phillips 66 as the "Company," "we"“Company,” “we” or "our."“our.” For more complete information regarding the Company's 2016Company’s 2017 performance, please review the Company'sCompany’s Annual Report on Form 10-K for the year ended December 31, 2016.If you are a beneficial owner and do not give your broker instructions on how to vote your shares, the broker will return the proxy card to us without voting on proposals not considered "routine." This is known as a broker non-vote. Only the ratification of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2017 is considered to be a routine matter. Your broker may not vote on any non-routine matters without instructions from you.Attend Our 2017 Annual Meeting of ShareholdersThe Annual Meeting is open to all shareholders of Phillips 66, and each shareholder may bring one guest. You will need an admission ticket or proof of stock ownership to attend the meeting. Additional information regarding attending the meeting can be found underAbout the Annual Meeting beginning on page 57.Date and Time:9:00 a.m. (CDT) on Wednesday, May 3, 2017Location:Houston Marriott Westchase2900 Briarpark DriveHouston, Texas 77042(713) 978-7400Record Date:March 10, 2017Proposals Requiring Your Vote MOREINFORMATIONBOARDRECOMMENDATIONVOTES REQUIRED FORAPPROVAL PROPOSAL 1Election of DirectorsPage 15FOR each NomineeMajority of votes castPROPOSAL 2Ratification of the Appointment of Ernst & Young LLPPage 23FORMajority of votes presentPROPOSAL 3Advisory Approval of ExecutiveCompensationPage 25FORMajority of votes present Vote Right AwayYour vote is very important to us and to our business. Even if you plan to attend our Annual Meeting in person, please read this proxy statement carefully and vote right away using any of the following methods. In all cases, have your proxy card or voting instruction card in hand and follow the instructions.BY INTERNET USING YOUR COMPUTERBY TELEPHONEBY MAILING YOUR PROXY CARD

![]()

Visit 24/7www.proxyvote.comDial toll-free 24/7(800) 690-6903Cast your ballot, sign your proxy cardand send by mail in the enclosed postage-paid envelopeIf you hold your Phillips 66 stock in a brokerage account (that is, in "street name"), your ability to vote by telephone or over the Internet depends on your broker's voting process. Please follow the directions on your proxy card or voting instruction card carefully. If you plan to vote in person at the Annual Meeting and you hold your Phillips 66 stock in street name, you must obtain a proxy from your broker and bring that proxy to the meeting.2017 PROXY STATEMENT 3If you hold your stock through a Phillips 66 employee benefit plan, please see page 58 for information about voting.

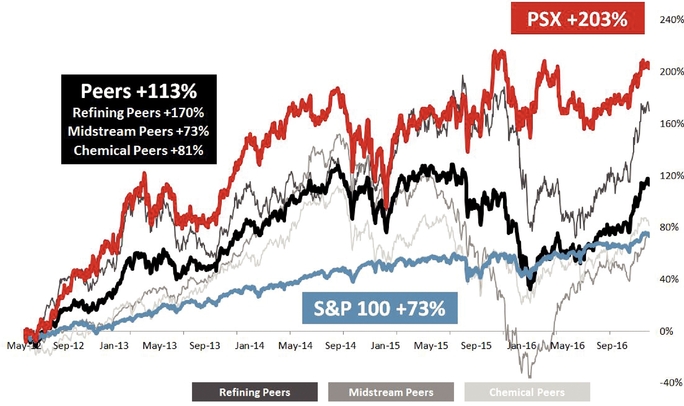

Visit 24/7www.phillips66.comReview and download this proxy statement and our Annual Report.Sign up for electronic delivery of future Annual Meeting materials to save money and reduce the impact on the environment at www.proxyvote.com.Midstream, Chemicals, Refining,midstream, chemicals, refining, and Marketingmarketing and Specialtiesspecialties businesses, the Company processes, transports, stores and markets fuels and products globally. Our industry is vitally important to the globalworld-wide economy. Fossil fuels, particularly oil and natural gas, are the world'sworld’s primary energy source and are expected to remain so for decades to come. These sources are abundant and reliable, affordable and efficient. Phillips 66's mission66’s vision is to provide energy and improve lives through operating excellence, delivering energy safely, efficiently and sustainably. We improve lives by responsibly providing energy products that are essential for a high standard of living and health throughout the world.Ourperformanceresults in 2016 demonstrated the resiliency of2017. We continued our diversified portfolio in a volatile market. We create value by focusingfocus on operating excellence, enhancingwith a record low safety rate. We also enhanced returns in our Refining business and executingexecuted on our Midstream and Chemicals businesses’ growth programs. Our balance sheet is strong, and we maintain a disciplined approach to capital allocation. The graph below showsIn 2017, we increased our total shareholder return (TSR) since May 2012 compareddividend by 11% and returned nearly $3 billion to the S&P 100 Indexshareholders through dividends and our performance peer group, which is detailed inPeer Group Comparisons—Performance Peer Group in theCompensation Discussion and Analysis.

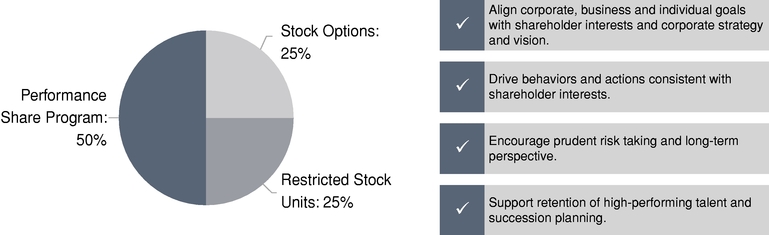

4 2017 PROXY STATEMENTPROXY SUMMARYSince the Company's inception in May 2012, our strategic priorities have remained unchanged. The following graphic summarizes highlights of our performance during 20162017 and for the three years ended December 31, 2017, as measured by our compensation program performance targets, which are discussed in theCOMPENSATION DISCUSSION AND ANALYSIS.Compensation DiscussionOperating Excellence—Drives focus on safety, asset availability and Analysisenvironmental stewardship..

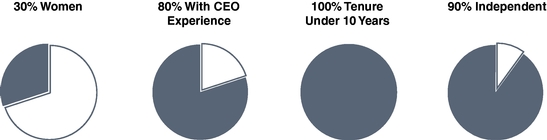

Summary In 2017, we exceeded our targets in every metric of Governance Best PracticesEarlier this year,operating excellence. Our combined workforce recordable injury rate was 0.14, which averages to one injury per every 1.4 million hours worked, and we had the lowest number of reportable environmental events in responseCompany history.feedbackbuild leadership capabilities and maximize the performance of our people in 2017. Approximately 25 percent of our employees were in locations impacted by Hurricane Harvey, yet almost all assets were operating by mid-September 2017.received fromwere able to manage while absorbing company growth.shareholders,target for the year.Board adopted a proxy access bylaw, whichTSR was 55.1 percent, ranking 7th out of 16 peers (including the S&P 100 Index).included amongevaluated on both an absolute and relative basis. For the three-year performance period ending in 2017, our corporate governance best practices summarized below:BEST PRACTICES ✓ Majority voting for Directors✓ Provide 3%/3 year/20% proxy access right✓ Robust shareholder engagement program covering large percentage of outstanding shares and proxy advisory firms✓ Substantial majority of independent Directors✓ Independent Lead Director with clearly defined responsibilities✓ IndependentYour Board Committees✓ Executive sessions of independent Directors✓ Stock ownership guidelines✓ Prohibition on pledging and hedging of our stock✓ Clawback policy✓ Regular Board and Committee self-evaluations✓ Risk oversight by the full Board and Committees✓ Company does not have a poison pill Board Diversity and IndependenceCompany'sCompany’s ongoing organizational commitment to diversity. In addition, theThe Nominating and Governance2017 PROXY STATEMENT 5PROXY SUMMARYCommittee, which we may also refer to as the Nominating Committee seeks Board members who possess the highest personal and professional ethics, integrity and values, and are committed to representing the long-term interests of the Company'sCompany’s shareholders. The Nominating Committee regularly reviews theCompany'sCompany’s businesses to ensure the Board reflects a range of talents, ages, skills, experiences, diversity, and expertise, particularly in the areas of accounting and finance, management, domestic and international markets, leadership, environment, and energy-related industries, sufficient to provide sound and prudent guidance with respect to the Company'sCompany’s strategic and operational objectives. The charts below highlight the diversity and independence of our ten-member Board of Directors.

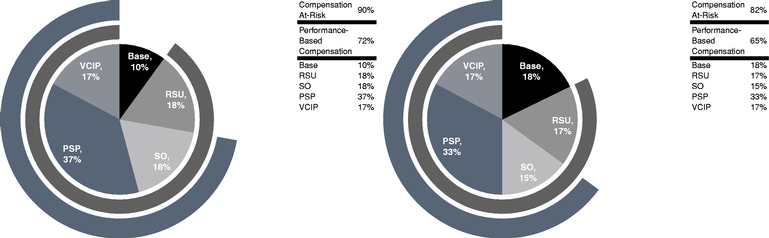

![[MISSING IMAGE: tv487943_pie-committee.jpg]](https://capedge.com/proxy/PRE 14A/0001144204-18-014335/tv487943_pie-committee.jpg)

RECOMMENDATION

FOR APPROVAL PROPOSAL 1 Election of Directors FOR each Nominee Majority of votes cast PROPOSAL 2 Ratification of the Appointment of Ernst & Young LLP FOR Majority of votes present PROPOSAL 3 Advisory Approval of Executive Compensation FOR Majority of votes present PROPOSAL 4 Management Proposal Regarding the Annual Election of Directors FOR 80% of Voting Stock Effortinvited shareholdersproactively sought feedback from our shareholders. Over 90% of our offers to engage were accepted, representing approximatelynearly half of our shares outstanding, to discuss topics of interestrelated to our shareholders. In response, shareholders provided valuable feedback that was shared with the full Board, which considered that feedback in its decision making process. Topics discussed included ourbusiness strategy and performance; corporateperformance, Board composition and oversight, as well as governance matters;and progress of our executive compensation programs; and environmental and social concerns. initiatives.discussions,engagements, we recently adopted a proxy access bylaw giving shareholders holding at least 3 percenthave decided to again seek shareholder approval of our shares for at least 3 years the right to include in the proxy statement director nominees for up to 20 percent of the Board (but not less than two nominees). In addition, we encouraged shareholders at the last two annual meetings to approve a management proposal to eliminate our classified board structure and permit all directors to be elected annually. Unfortunately,More information about the proposal did not receivetopics discussed and the required vote to passactions we have taken can be found in either year. We consulted with our proxy solicitor, who advised us, based on its analysisSHAREHOLDER AND COMMUNITY ENGAGEMENT.our shareholder base, that the proposal would likely not be successful this year. We also discussed this topic with our largest investors and they conveyed understanding for this conclusion. Therefore, weGovernance Best Practicesnot resubmitting the proposal at the Annual Meeting, but will continue to discuss this matter and others with our investors to ensure they have a meaningful voice in our boardroom.In addition, the Human Resources and Compensation Committee, which we refer to as the Compensation Committee, values these discussions and encourages shareholders to provide comments about our executive compensation programs. Based on the overwhelmingly positive result of our 2016 say-on-pay vote (95% support), as well as the feedback received during ongoing shareholder engagement meetings, we believe our shareholders approve of our executive compensation program and recognize its link to our business strategy. Nevertheless, we continue to evaluate our compensation program in light ofsummarized below. Our Board regularly reviews evolving corporate governance best practices, to ensure alignment with shareholder interests.6 2017 PROXY STATEMENTPROXY SUMMARYSummary of Compensation Best PracticesIn conjunction with our corporate strategy, executive compensation philosophy and shareholder feedback, the following best practices are reflected in our executive compensation programs: WE DO ...WE DO NOT ... Target Named Executive Officer (NEO) compensation to be performance basedindependent directors✗ Provide excise tax gross-ups to our NEOs under our CICSP✓ Link NEO compensation to shareholder value creation by having a significant portion of compensation at risk✗ Reprice stock options without shareholder approval✓ Apply multiple performance metrics aligned with our corporate strategy to measure our performance✗ Price stock options below grant date fair market value✓ Cap maximum payouts (number of shares) under our equity programs✗ Allow share recycling for stock options Employ a "double trigger" for severance benefitsequity awards underhedging of our Key Employee Change in Control Severance Plan (CICSP)stock✗ Have evergreen provisions in our active equity plans✓ Include absolute and relative metrics in our Long-Term Incentive (LTI) programs✗ Allow hedging or pledging of Phillips 66 stock, or trading Phillips 66 stock outside of approved windows✓ Maintain stock ownership guidelines for executives—Chief Executive Officer (CEO) 6x base salary; other NEOs 3-5x base salary✗ Pay dividends during the performance period on Performance Share Program (PSP) targets✓ Balance, monitor and manage compensation risk through regular assessments and robust clawback provisions✗ Allow transfer of equity awards (except in the case of death)✓ Have extended vesting periods on stock awards, with a minimum one-year vesting period required for stock and stock option awards✗ Provide separate supplemental executive retirement benefits for individual NEOs✓ Intend to qualify compensation payments for deductibility under Internal Revenue Code (IRC) Section 162(m)✗ Maintain individual change-in-control agreements✓ Maintain a fully independent Compensation Committee✗ Have an employment agreement with the CEO✓ Retain an independent compensation consultant✗ Have excessive perquisites✓ Hold a Say-on-Pay vote annually2017 PROXY STATEMENT 7

![[MISSING IMAGE: lg_phillips66.jpg]](https://capedge.com/proxy/PRE 14A/0001144204-18-014335/lg_phillips66.jpg)

22, 2017,28, 2018, in connection with the solicitation by the Board of Directors of Phillips 66 of proxies to be voted at the 20172018 Annual Meeting of Shareholders on May 3, 2017.The Nominating Committeewhich we may also refer to as the Board, annually review the Company's governance structure to take into account changes in Securitiesoversees and Exchange Commission (SEC) and New York Stock Exchange (NYSE) rules, as well as current best practices. Our Corporate Governance Guidelines, posted on the "Investors" section of the Company's website under the "Governance" caption and available in print upon request (seeAvailable Information on page 61), address the following matters, among others:•director qualifications•director responsibilities•committees of the Board•director access to officers, employees and independent advisors•performance evaluations of the Board•director orientation and continuing education•director compensation•Chief Executive Officer (CEO) evaluation and succession planningChairman and CEO RolesAlthough the Board of Directors has the authority to separate the positions of Chairman and CEO if it deems appropriate, the Board believes it iscounsels management in the bestlong-term interest of the Company's shareholders to combine them. Doing so enables one person to guide the Board in setting priorities for the Company and in addressing the risks and challenges the Company faces. The Board of Directors believes that, while its non-employee Directors bring a diversity of skills and perspectives to the Board, the Company's CEO, by virtue of his day-to-day involvement in managing the Company, currently is best suited to serve as Chairman and perform this unified role.The Board of Directors believes that no single organizational model is the most effective in all circumstances. As a consequence, the Board periodically considers whether the offices of Chairman and CEO should continue to be combined and who should serve in such capacities. The Board also periodically reexamines its corporate governance policies and leadership structure to ensure that they continueour shareholders. We continuously strive to meet the Company's needs. As partour vision of this review, the Board rotated committee chairsproviding energy and committee membership in 2016. The decision to rotate committee positions was not taken lightly given the benefits that can come from continuity and the expertiseimproving lives, guided by our four pillars of members. The Nominating Committee, however, believed that rotating committee positions would be beneficial, providing fresh perspectives and enhancing Directors' familiarity with different aspects of the Company's business while maintaining subject matter expertise on all committees.8 2017 PROXY STATEMENT

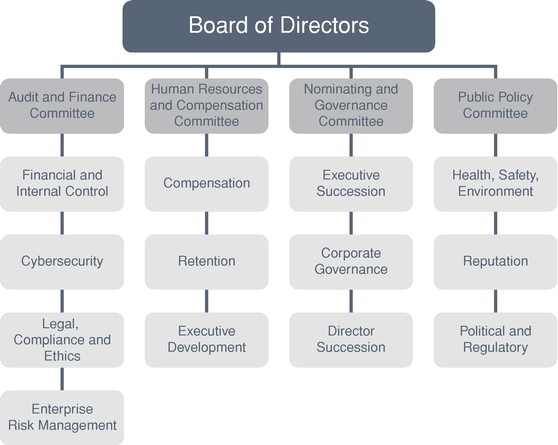

•CORPORATE GOVERNANCE OF THE COMPANYIndependent Director LeadershipThestrong governance practices to ensure that an appropriate balance of power exists between the non-employee Directors and management, including:•appointing a Lead Director•requiring a substantial majority of independent directors•having only independent directors serve on the Audit and Finance Committee, which we may also refer to as the Audit Committee; the Compensation Committee; and the Nominating Committee•holding executive sessions of the non-employee Directors at each Board meeting•having only independent directors evaluate the CEO's performance annually and approve the CEO's payGlenn Tilton has served as our Lead Director since February 2016. In appointing a Lead Director, the Board of Directors considered it useful and appropriate to designate an independent Director to serve in a lead capacity to coordinate the activities of the non-employee Directors and to perform such other duties and responsibilities as the Board of Directors may determine. Specifically, those duties include:•advising the Chairman on an appropriate schedule of Board meetings, seeking to ensure that the non-employee Directors can perform their duties responsibly without interfering with operations•providing the Chairman with input on the preparation of the agenda for each Board meeting and assuring that there is sufficient time for discussion of all agenda items•advising the Chairman on the quality, quantity and timeliness of the flow of information from management to the non-employee Directors in order that they may perform their duties effectively and responsibly, including specifically requesting certain materials be provided to the Board•recommending to the Chairman the retention of consultants who report directly to the Board of Directors•interviewing all board candidates and making nomination recommendations to the Nominating Committee and the Board of Directors•assisting the Board of Directors and Company officers in assuring compliance with and implementation of the Corporate Governance Guidelines•ensuring that he or she or another appropriate Director is available for engagement with shareholders when warranted•having the authority to call meetings of the non-employee Directors, as well as to develop the agenda for and moderate any such meetings and executive sessions of the non-employee Directors•acting as principal liaison between the non-employee Directors and the Chairman on sensitive issues•participating with the Compensation Committee in the periodic discussion of CEO performance•ensuring the Board of Directors conducts an annual self-assessment and meeting with the CEO to discuss the results of the annual self-assessment•working with the Nominating Committee to recommend the membership of the various Board committees, as well as selection of the committee chairsThe Board of Directors believes that its current structure and processes encourage its non-employee Directors to be actively involved in guiding its work. The chairs of the Board's committees review their respective agendas and committee materials in advance of each meeting, communicating directly with other Directors and members of management as each deems appropriate. Moreover, each Director is free to suggest agenda items and to raise matters at Board and committee meetings that are not on the agenda.Our Corporate Governance Guidelines require that the non-employee Directors meet in executive session at every Board meeting and, when there are non-employee Directors who are not independent, that the independent Directors meet in executive session at least annually. The Lead Director presides at such executive sessions. Each executive session may include discussionsestablish a common set of among other things, (1) the performance of the Chairman and the CEO, (2) matters concerning the2017 PROXY STATEMENT 9CORPORATE GOVERNANCE OF THE COMPANYrelationship of the Board of Directors with the members of senior management, and (3) such other matters as the non-employee Directors deem appropriate. No formal action of the Board of Directors is taken at these meetings, although the non-employee Directors may subsequently recommend matters for consideration by the full Board. The Board of Directors may invite guest attendees to make presentations, respond to questions, or provide counsel on specific matters within their areas of expertise.Effective October 2016, based upon the recommendation of the Nominating Committee, the membership of the Board committees was revised as set forth below.MR.ADAMSMR.FERGUSONMR.GARLANDMR.LOOMISMR.LOWEMR.MCGRAWMS.RAMOSMR.TILTONMS.TSCHINKELDR.WHITTINGTON Audit and FinanceX*XXXXExecutiveXX*XXXXHuman Resources and CompensationXXXX*Nominating and GovernanceXX*XXPublic PolicyXXXX*XXXXX *Committee ChairThe charters for our Audit Committee, Executive Committee, Compensation Committee, Nominating Committee, and Public Policy Committee can be found in the "Investors" section on the Phillips 66 website under the "Governance" caption. Shareholders may also request printed copies of these charters by following the instructions located under the captionAvailable Information on page 61.The Corporate Governance Guidelines also contain director independence standards, which are consistent with the standards set forth in the NYSE listing standards,expectations to assist the Board of Directorsand its committees in determining the independence of the Company's Directors.performing their duties. The Board of Directors has determined that each Director, except Mr. Garland, meets the standards regarding independence set forth in theGuidelines are reviewed at least annually, and updates are made as necessary to reflect changing regulatory requirements, evolving best practices and input from shareholders and other stakeholders.and is free of any material relationship with the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company). Mr. Garland is not considered independent because he is an executive officer of the Company. In making independence determinations, the Board of Directors specifically considered the fact that manyCharters of our Directors are directors, current or retired officers or shareholdersBoard’s committees, our By-Laws, and our Code of companies with which we conduct business. In addition, some of our Directors serve as employees of, or consultants to, companies that do business with Phillips 66Business Ethics and its affiliates (as further described inRelated Party Transactions on page 13). Finally, some of our Directors may purchase retail products (such as gasoline, fuel additives or lubricants) from the Company. In all cases, it was determined that the nature of the business conducted and the interest of the Director by virtue of such position were immaterial both to the Company and to such Director. SHAREHOLDER AND COMMUNITY ENGAGEMENTThe Company's values embrace shareholder engagement as an important tenet of good governance. We value the views of our shareholders and believe that positive dialogue builds informed relationships that promote transparency and accountability. Although the Lead Director or other members of the Board are available to participate in meetings with shareholders as appropriate, management has the principal responsibility for shareholder communication. As part of our annual engagement efforts in 2016, we invited shareholders representing approximately half of our shares outstanding, and other interested parties, to discuss matters of interest to them. Topics discussed included our strategy and performance; corporate governance matters; our executive compensation programs; and environmental and social concerns. The valuable feedback received was then shared with the full Board, which considered the feedback in its decision making process. As a direct result of these discussions, we adopted a proxy access bylaw giving shareholders holding at least 3 percent of our shares for at least 3 years the right to include in the proxy statement director nominees for up to 20 percent of the Board (but not less than two nominees). In addition, we encouraged shareholders at the last two annual meetings to approve a10 2017 PROXY STATEMENTCORPORATE GOVERNANCE OF THE COMPANYcharter amendment that would eliminate the classified board structure and permit all directors to be elected annually. Unfortunately, the proposal did not receive the required vote to pass in either year. We consulted with our proxy solicitor, who advised us, based on its analysis of our shareholder base, that the proposal would likely not be successful this year. We also discussed this topic with our largest investors and they conveyed understanding for this conclusion. Therefore, we are not resubmitting the proposal at the Annual Meeting, but will continue to assess the proposal and its potential for adoption in the future.We also believe that engagement and good governance involve participating in political or public policy activities that advance the Company's goals, are consistent with Company values and improve the communities where we work and live. A number of federal, state and local laws govern corporate involvement in such activities, and we maintain policies and procedures to comply with these laws. The Public Policy Committee is responsible for overseeing our political and public policy work and related activities about which it receives regular reports. Additional information about our involvement in political or public policy activities is available on our website.Phillips 66 is dedicated to meeting the world's energy needs responsibly, efficiently and sustainably. For us, sustainability means manufacturing and delivering affordable, clean products in a safe and environmentally sound manner. Our sustainability efforts are built on four pillars: operational excellence, environmental commitment, social responsibility and economic performance.More than one-third of our U.S. refineries have earned the U.S. Environmental Protection Agency ENERGY STAR® Award, which recognizes their top-quartile energy efficiency performance. In addition, 25 of our sites have received Voluntary Protection Program (VPP) certification for their strong safety records and comprehensive safety and health management systems.Our commitment to excellence compels us to invest in environmental projects and sustaining capital to improve our operations. The results are industry-leading practices and improved environmental performance. We invested more than $5.4 billion in refining environmental projects and improvements from 2003 through 2015. During that time, we reduced SOx emissions by 90 percent, NOx emissions by 55 percent and particulate matter by 57 percent.Phillips 66 is investing in its future by conducting research to manage water consumption, improve energy efficiency and provide technology to change the future of power generation. We seek solutions for tomorrow's energy needs, from opportunities to blend biofuels into clean products to co-founding forward-looking think tanks, such as the Fuels Institute. Phillips 66 is one of the few energy companies with a state-of-the-art Research Center. We have more than 350 scientists and engineers in Bartlesville, Oklahoma, conducting research to enhance the safety and reliability of our operations and to develop future air, water and energy solutions.Additional information regarding our commitment to sustainability, including our Sustainability Highlights Brochure,Conduct can be found on the Company’s website in the “Investors” section, under the “Corporate Governance” caption. We also publish a Sustainability sectionReport, which presents our sustainability efforts and provides data, as well as programs and projects that demonstrate how we fulfill our vision of our website.To support shareholder engagement,providing energy and improving lives. The Sustainability Report can be found on the Company maintains a process for shareholders and interested parties to communicate with the Board of Directors. Shareholders and interested parties may communicate with the Board of Directors by contacting our Corporate Secretary, Paula A. Johnson, as provided below:Mailing Address:Corporate SecretaryPhillips 66P.O. Box 4428Houston, TX 77210Phone Number:(281) 293-6600Internet:"Investors" section of the Company's website (www.phillips66.com) under the "Governance" captionRelevant communications are distributed to the Board of Directors or to any individual Director or Directors, as appropriate, depending on the facts and circumstances outlined in the communication. In that regard, the Board has requested that2017 PROXY STATEMENT 11CORPORATE GOVERNANCE OF THE COMPANYcertain items unrelated to its duties and responsibilities not be distributed, such as: business solicitations or advertisements; junk mail and mass mailings; new product suggestions; product complaints; product inquiries; résumés and other forms of job inquiries; spam; and surveys. In addition, material that is considered hostile, threatening, illegal or similarly unsuitable will be excluded. Any communication that is filtered out is made available to any non-employee Director upon request.Recognizing that director attendance at the Company's Annual Meeting can provide the Company's shareholders with an opportunity to communicate with the Directors about issues affecting the Company, the Company actively encourages our Directors to attend the Annual Meeting of Shareholders. All of our Directors attended the 2016 Annual Meeting of Shareholders.The Board of Directors met six times in 2016. Each Director attended at least 75 percent of the aggregate of:•the total number of meetings of the Board held in 2016 during his or her tenure, and•the total number of full-committee meetings held in 2016 by all committees of the Board on which he or she served.The Company's management is responsible for the day-to-day conduct of our businesses and operations, including management of risks the Company faces. To fulfill this responsibility, our management has established an enterprise risk management program designed to identify and facilitate management of the significant and diverse risks facing the Company and the approaches to mitigate such risks. The Board of Directors has broad oversight responsibility over the Company's enterprise risk management program and receives management updates on its development and implementation. In this oversight role, the Board of Directors is responsible for satisfying itself that the risk management processes designed and implemented by the Company's management are functioning as intended, and that necessary steps are taken to foster a culture of risk-adjusted decision making throughout the organization.In executing its responsibilities, the Board of Directors has delegated to individual committees certain elements of this oversight function, while retaining oversight responsibility for strategic risks. In this context, the Board of Directors delegated authority to the Audit Committee to facilitate coordination among the Board's committees with respect to oversight of the Company's risk management programs. Accordingly, the Audit Committee regularly receives updates on the enterprise risk management program and discusses the Company's risk assessment and risk management policies to ensure that our risk management programs are functioning properly.The Board of Directors, either directly or through its committees, exercises its oversight function with respect to all material risks to the Company, which are identified and discussed in the Company's public filings with the SEC. The Board of Directors12 2017 PROXY STATEMENTCORPORATE GOVERNANCE OF THE COMPANYreceives regular updates from its committees on individual areas of risk falling within each committee's area of oversight and expertise, as outlined below:

Phillips 66 hasfor Directors and Employees designed to help resolve ethical issues in an increasingly complex global business environment. Our Code of Business Ethicsprovide guidance on how to act legally and Conduct applies to all directors and employees, including the CEO and the Chief Financial Officer.ethically while performing work for Phillips 66. Our Code of Business Ethics and Conduct covers topics including, but not limited to, conflicts of interest, insider trading, competition and fair dealing, discrimination and harassment, confidentiality, payments to government personnel, anti-boycott laws, U.S. embargoes and sanctions, compliance procedures and employee complaint procedures. OurAll of our directors and employees, including our Chief Executive Officer (CEO), Chief Financial Officer (CFO), and other senior finance personnel, are subject to compliance with the Code of Business Ethics and ConductConduct.postedavailable on our website."feedback we received.Investors" section later in this proxy statement."“Sustainability” section, seeks to provide a comprehensive resource for interested parties to learn about our sustainability policies and programs, with links to a suite of Company information, including policies, positions, educational information, and other reports.

ADAMS

FERGUSON

GARLAND

LOOMIS

LOWE

MCGRAW

RAMOS

TILTON

TSCHINKEL

WHITTINGTON Experience (Skills and Qualifications) Public Company CEO ✔ ✔ ✔ ✔ ✔ Financial Reporting ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ Industry ✔ ✔ ✔ ✔ ✔ ✔ ✔ Global ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ Environmental ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ Risk Management ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ Demographic/Background Independent Yes Yes No Yes Yes Yes Yes Yes Yes Yes Gender Male Male Male Male Male Male Female Male Female Female Tenure (years) 1.4 5.9 5.9 5.9 5.9 5.9 1.4 5.9 5.9 5.8 Age (years) 67 63 60 69 59 69 61 69 70 70 "RELATED PARTY TRANSACTIONS). Additionally, some of our directors may purchase retail products (such as gasoline, fuel additives or lubricants) from the Company. In all cases, it was determined that the nature of the business conducted and the interest of the director by virtue of such position were immaterial both to the Company and to the director.

ADAMS

FERGUSON

GARLAND

LOOMIS

LOWE

MCGRAW

RAMOS

TILTON

TSCHINKEL

WHITTINGTON Audit and Finance Chair X X X X Executive X Chair X X X X Human Resources and Compensation X X X Chair Nominating and Governance X Chair X X Public Policy X X X Chair X X X X X our Code of Business Ethics and Conductthese charters by following the instructions located under AVAILABLE INFORMATION.captionAvailable InformationBoard

William R. Loomis, Jr.

John E. Lowe

Denise L. Ramos

Victoria J. Tschinkel

J. Brian Ferguson

William R. Loomis, Jr.

John E. Lowe

Glenn F. Tilton

Marna C. Whittington

Gary K. Adams

Harold W. McGraw III

Glenn F. Tilton

J. Brian Ferguson

Denise L. Ramos

Marna C. Whittington

Gary K. Adams

J. Brian Ferguson

William R. Loomis, Jr.

Harold W. McGraw III

Denise L. Ramos

Glenn F. Tilton

Victoria J. Tschinkel

Marna C. Whittington page 61.bring to the attention of the General Counsel and, in the case of Directors, the Chair of the Nominating Committeereport any transactions or in the case of executive officers, the Chair of the Audit Committee, any transaction or relationship that arises and of which she or he becomes awarerelationships that reasonably could be expected to constitute a related party transaction. Any suchThe transaction or relationship is reviewed by the Company'sCompany’s management and the appropriate committee of the Board Committee to ensure that it does not constitute a conflict of interest and is reported appropriately. appropriately disclosed.of our directorsdirector and the Company (andand its subsidiaries) and makessubsidiaries in making recommendations to the Board regarding the continued independence of each Board member.director. In 2016,2017, there were no related party transactions in which the Company (oror a subsidiary)subsidiary was a participant and in which any director, or executive officer, (oror any of their immediate2017 PROXY STATEMENT 13CORPORATE GOVERNANCE OF THE COMPANYmembers)members had a direct or indirect material interest. BOARD AND COMMITTEE EVALUATIONSEach committee performsannual self-assessment, andaggregate purchase price of approximately $3.3 billion. The purchase price for the Nominating Committee and Lead Director oversee an annual self-assessmentshares was based on the volume weighted average price of our common stock on the NYSE on the date of the Board,agreement, which includes an evaluation surveyclosed on February 14, 2018.individual discussions betweeninterested parties to communicate with non-employee directors. Shareholders and interested parties may communicate with the Lead Director and each other Director. A summary of the results of each committee's self-assessment is presented to the committee and discussed in executive session. The Lead Director presents a summary of the results of the Board evaluation to the Board in executive session. Any matters requiring further action are identified and action plans developed to address the matter. NOMINATING PROCESSES OFTHE NOMINATING AND GOVERNANCE COMMITTEEThe Nominating Committee consists of four non-employee Directors, all of whom are independent under NYSE listing standards anddirectors by contacting our Corporate Governance Guidelines. The Nominating Committee identifies, considers and recommends director candidatesSecretary, Paula A. Johnson, as provided below: Mailing Address: Corporate Secretary

Phillips 66

P.O. Box 421959

Houston, TX 77242-1959 Phone Number: (281) 293-6600 Internet: “Investors” section of the Company’s website (www.phillips66.com) under the “Corporate Governance” caption withor to any individual director or directors, as appropriate, depending on the goalfacts and circumstances outlined in the communication. In that regard, the Board has requested that certain items unrelated to its duties and responsibilities not be distributed, such as: business solicitations or advertisements; junk mail and mass mailings; new product suggestions; product complaints; product inquiries; résumés and other forms of creating a balance of knowledge, experiencejob inquiries; spam; and diversity. Generally, the Nominating Committee identifies candidates through the use of a search firm or the business and organizational contacts of the directors and management. Our By-Laws permit shareholders to nominate candidates for director election at a shareholders meeting whether or not such nominee is submitted to and evaluated by the Nominating Committee. Shareholders who wish to submit nominees for election at an annual or special meeting of shareholders should follow the procedures described underSubmission of Future Shareholder Proposals on page 61. The Nominating Committee will consider director candidates recommended by shareholders. If a shareholder wishes to recommend a candidate for nomination by the Nominating Committee, he or she should follow the same procedures referred to above for nominations to be made directly by the shareholder.surveys. In addition, the shareholder should provide such other information deemed relevantmaterial that is considered hostile, threatening, illegal or similarly unsuitable will be excluded. Any communication that is filtered out is made available to the Nominating Committee's evaluation. Candidates recommended by the Company's shareholders are evaluated on the same basis as candidates recommended by the Company's directors, CEO, other executive officers, third-party search firms or other sources.any non-employee director upon request.14 2017ContentsDirectorsdirectors are divided into three classes, which are to be as nearly equal in size as possible, with one class being elected each year. The Board of Directors has set the current number of Directorsdirectors at ten, with two classes of three Directorsdirectors each and one class of four Directors.directors. Any director vacancies created between annual shareholder meetings (such as by a current director'sdirector’s death, resignation or removal for cause or an increase in the number of directors) may be filled by a majority vote of the remaining directors then in office. Any director appointed in this manner would hold office for a term expiring at the annual meeting of shareholders at which the term of office of the class to which he or she has been appointed expires. If a vacancy resulted from an action of our shareholders, only our shareholders would be entitled to elect a successor.Directors,directors, please see the the discussion beginning on page 53.20172018 Annual Meeting

for a three-year term endingThree-Year Term Ending at the 20202021 Annual Meeting"FOR"“FOR” EACH OF THE FOLLOWING DIRECTOR NOMINEES. William R. Loomis, Jr.![[MISSING IMAGE: ph_brian-ferguson02.jpg]](https://capedge.com/proxy/PRE 14A/0001144204-18-014335/ph_brian-ferguson02.jpg)

6863

Director since April 2012 ![[MISSING IMAGE: ph_harold-mcgraw02.jpg]](https://capedge.com/proxy/PRE 14A/0001144204-18-014335/ph_harold-mcgraw02.jpg)

Director since April 2012

Mr. Loomis has been an independent financial advisor since 2009. He was a general partner and Managing DirectorLazard Freres & Co. from 1984 to 2002, the CEO of Lazard LLC from 2000 to 2001 and a Limited Managing Director of Lazard LLC from 2002 to 2004. Mr. Loomis served as a director of L Brands Inc. from 2005 to 2016.Skills and qualifications:Mr. Loomis has extensive executive experience and financial expertise, as well as substantial history as a senior strategic advisor to complex businesses and multiple executives.2017 PROXY STATEMENT 15PROPOSAL 1: Election of Directors![[MISSING IMAGE: ph_victoria-tschinkel02.jpg]](https://capedge.com/proxy/PRE 14A/0001144204-18-014335/ph_victoria-tschinkel02.jpg)

Glenn F. TiltonAge 68Director since April 2012

Mr. Tilton served as Chairman of the Midwest of JPMorgan Chase & Co. from 2011 to June 2014. From September 2002 to October 2010, he served as Chairman, President and CEO of UAL Corporation, a holding company, and United Air Lines, Inc., an air transportation company and wholly-owned subsidiary of UAL Corporation. Mr. Tilton previously spent more than 30 years in increasingly senior roles with Texaco Inc., including Chairman and CEO in 2001. He served as Non-Executive Chairman of the Board of United Continental Holdings Inc. from 2010 to 2013 and currently serves on the boards of Abbott Laboratories and AbbVie Inc. (as lead director).Skills and qualifications:Mr. Tilton has strong management experience overseeing complex multinational businesses operating in highly regulated industries, as well as 30 years of experience in the energy industry and expertise in finance and capital markets matters.Marna C. WhittingtonAge 69Director since May 2012

Dr. Whittington was CEO of Allianz Global Investors Capital, a diversified global investment firm, from 2002 until her retirement in January 2012. She was Chief Operating Officer of Allianz Global Investors, the parent company of Allianz Global Investors Capital, from 2001 to 2011. Prior to that, she was Managing Director and Chief Operating Officer of Morgan Stanley Asset Management. Dr. Whittington started in the investment management industry in 1992, joining Philadelphia-based Miller Anderson & Sherrerd. Previously, she was Executive Vice President and CFO of the University of Pennsylvania, from 1984 to 1992. Earlier, she served as Budget Director and, subsequently, Secretary of Finance for the State of Delaware. Dr. Whittington served on the board of Rohm & Haas Company from 1989 to 2009 and currently serves on the boards of Macy's, Inc. and Oaktree Capital Group, LLC.Skills and qualifications:Dr. Whittington has extensive knowledge of and substantial experience in financial, investment, and banking matters, and has served on compensation committees. She also provides valuable insight from her previous experience serving on the board of a chemicals company and as a statewide cabinet officer.16 2017 PROXY STATEMENTPROPOSAL 1: Election of DirectorsDirectorsdirectors will continue in office until the end of their respective terms. Included below is a listing of each continuing Director'sdirector’s name, age, tenure and qualifications.Directors Whose Terms Expire at the 2018 Annual MeetingJ. Brian FergusonAge 62Director since April 2012

Mr. Ferguson retired as Chairman of Eastman Chemical Company (Eastman) in 2010 and as CEO of Eastman in 2009. He became the Chairman and CEO of Eastman in 2002. He served on the board of NextEra Energy Inc. from 2005 to 2013 and currently serves on the board of Owens Corning.Skills and qualifications:Mr. Ferguson has over 30 years of leadership experience in international business, industrial operations, strategic planning and capital raising strategies.Harold W. McGraw IIIAge 68Director since April 2012

Mr. McGraw is Chairman Emeritus of S&P Global Inc. (previously McGraw Hill Financial), having served as Chairman of the Board from 1999 until 2015, as President and Chief Executive Officer from 1998 to November 2013 and as President and Chief Operating Officer starting in 1993. Mr. McGraw is the Honorary Chairman of the International Chamber of Commerce. He currently serves on the board of United Technologies Corporation.Skills and qualifications:Mr. McGraw's experience leading a large, global public company with a significant role in the financial reporting industry provides him with valuable global financial, corporate governance and operational expertise.2017 PROXY STATEMENT 17PROPOSAL 1: Election of DirectorsVictoria J. TschinkelAge 69Director since April 2012

Ms. Tschinkel currently serves as the Vice-Chairwoman of 1000 Friends of Florida and previously was its Chairwoman. In addition, Ms. Tschinkel is a director of the National Fish and Wildlife Foundation, serving on the Gulf Benefits Committee. She served as State Director of the Florida Nature Conservancy from 2003 to 2006, was senior environmental consultant to Landers & Parsons, a Tallahassee, Florida law firm, from 1987 to 2002, and was the Secretary of the Florida Department of Environmental Regulation from 1981 to 1987.Skills and qualifications:Ms. Tschinkel's extensive environmental regulatory experience makes her well qualified to serve as a member of the Board. In addition, her relationships and experience working within the environmental community position her to advise the Board on the impact of our operations in sensitive areas. ![[MISSING IMAGE: ph_greg-garland02.jpg]](https://capedge.com/proxy/PRE 14A/0001144204-18-014335/ph_greg-garland02.jpg)

5960

Mr. Garland serves as Chairman and CEO of Phillips 66. He was appointed Senior Vice President, Exploration and Production-Americas for ConocoPhillips in 2010. He was previously President and CEO of Chevron Phillips Chemical Company LLC (CPChem) from 2008 to 2010, having served as Senior Vice President, Planning and Specialty Products, CPChem, from 2000 to 2008. Mr. Garland also serves on the boards of Amgen Inc. and Phillips 66 Partners GP LLC, the general partner of Phillips 66 Partners LP.Skills and qualifications:Mr. Garland's more than 35-year career with Phillips Petroleum Company, CPChem and ConocoPhillips, and as CEO of Phillips 66, makes him well qualified to serve both as a Director and as Chairman of the Board. Mr. Garland's extensive experience in the energy industry makes his service as a Director invaluable to the Company. In addition to his other skills and qualifications, Mr. Garland's role as both Chairman and CEO of Phillips 66 serves as a vital link between the Board of Directors and management, allowing the Board to perform its oversight role with the benefit of management's perspective on business and strategy.18 2017 PROXY STATEMENTPROPOSAL 1: Election of DirectorsGary K. AdamsAge 66Director since October 2016

Mr. Adams was appointed to the Board in October 2016 based on a recommendation by the Company's Chief Executive Officer and the Nominating Committee. Mr. Adams is currently the chief advisor of chemicals for IHS Inc. He started his chemical industry career with Union Carbide. After 15 years serving in a number of positions at Union Carbide, Mr. Adams joined Chemical Market Associates Inc. (CMAI). He served as President, CEO and Chairman of the Board of CMAI from 1997 until its acquisition by IHS in 2011.Mr. Adams is a director of Trecora Resources and previously served on the boards of Westlake Chemical Partners LP from 2014 to 2016 and Phillips 66 Partners LP from 2013 to 2016.Skills and qualifications:Mr. Adams has a lengthy tenure and extensive experience in the energy industry, including leadership experience with operating responsibilities and in-depth knowledge of the chemicals market.John E. LoweAge 58Director since April 2012

Mr. Lowe served as assistant to the CEO of ConocoPhillips, a position he held from 2008 until May 2012. He previously held a series of executive positions with ConocoPhillips, including Executive Vice President, Exploration and Production, from 2007 to 2008, and Executive Vice President, Commercial, from 2006 to 2007. Mr. Lowe is a Senior Executive Advisor to Tudor, Pickering, Holt & Co. He served on the board of Agrium Inc. from 2010 to 2015 and currently serves on the boards of TransCanada Corporation and Apache Corporation, where he is non-executive Chairman.Skills and qualifications:Mr. Lowe has relevant industry financial expertise in addition to his extensive experience in and knowledge of the energy industry.2017 PROXY STATEMENT 19PROPOSAL 1: Election of DirectorsDenise L. RamosAge 60Director since October 2016

Ms. Ramos was appointed to the Board in October 2016 based on a recommendation by the Company's Chief Executive Officer and the Nominating Committee. Ms. Ramos has served as the Chief Executive Officer, President and a director of ITT Inc. (formerly ITT Corporation) since October 2011. She previously served as Senior Vice President and Chief Financial Officer of ITT. Prior to joining ITT, Ms. Ramos served as Chief Financial Officer for Furniture Brands International from 2005 to 2007. From 2000 to 2005, Ms. Ramos served as Senior Vice President and Corporate Treasurer at Yum! Brands, Inc. and Chief Financial Officer for the U.S. division of KFC Corporation. Ms. Ramos began her career in 1979 at Atlantic Richfield Company (ARCO), where she spent more than 20 years serving in a number of finance positions including Corporate General Auditor and Assistant Treasurer.Ms. Ramos served on the board of Praxair, Inc. from 2014 to 2016. She serves on the board of trustees for the Manufacturers Alliance for Productivity and Innovation, and is also a member of the Business Roundtable and the Business Council.Skills and qualifications:Ms. Ramos has more than two decades of experience in the oil and gas industry and possesses significant retail and customer-centric experience. In addition to her financial expertise, she has extensive operational and manufacturing experience with industrial companies.Majority VotingOur By-Laws require directors to be elected by the majority of the votes cast with respect to such director (i.e., the number of votes cast "for" a director must exceed the number of votes cast "against" that director). If a nominee who is serving as a Director is not elected at the Annual Meeting and no one else is elected in place of that Director, then, under Delaware law, the Director would continue to serve on the Board of Directors as a "holdover director." However, under our By-Laws, the holdover director would be required to tender his or her resignation to the Board. The Nominating Committee then would consider and recommend to the Board whether to accept or reject the tendered resignation, or whether some other action should be taken. The Board of Directors would then decide whether to accept the resignation, taking into account the recommendation of the Nominating Committee. The Director who tenders his or her resignation would not participate in the recommendation of the Nominating Committee or the decision of the Board with respect to his or her resignation. The Board is required to publicly disclose (by a press release, a filing with the SEC or other broadly disseminated means of communication) its decision regarding the tendered resignation and the rationale behind the decision within 90 days from the date of the certification of the election results. In a contested election (a situation in which the number of nominees exceeds the number of directors to be elected), the standard for election of directors will be a plurality of the shares represented in person or by proxy at any such meeting and entitled to vote on the election of directors.NominationsIn selecting the 2017 nominees for Director, the Nominating Committee sought candidates who possess the highest personal and professional ethics, integrity and values and are committed to representing the long-term interests of the Company's shareholders. In addition to reviewing a candidate's background and accomplishments, the Nominating Committee reviewed candidates in the context of the current composition of the Board and the evolving needs of the Company's businesses. The Nominating Committee also considered the number of boards on which the candidate already serves. It is the Board's policy that at all times at least a substantial majority of its members meets the standards of independence promulgated by the NYSE and the SEC, and as set forth in the Company's Corporate Governance Guidelines. The Nominating Committee also seeks to ensure that the Board reflects a range of talents, ages, skills, experiences, diversity, and expertise, particularly in the areas of accounting and finance, management, domestic and international markets, leadership, and energy-related industries, sufficient to provide sound and prudent guidance with respect to the Company's strategic and operational20 2017 PROXY STATEMENTPROPOSAL 1: Election of Directorsobjectives. The Board seeks to maintain a diverse membership, but does not have a separate policy on diversity. The Board also requires that its members be able to dedicate the time and resources necessary to ensure the diligent performance of their duties on the Company's behalf, including attending Board and applicable committee meetings.The following are some of the key qualifications and skills the Nominating Committee considered in evaluating the director nominees. The individual biographies above provide additional information about each nominee's specific experiences, qualifications and skills.•CEO experience. Directors with experience as CEOs of public corporations provide the Company with valuable insights. These individuals have a demonstrated record of leadership and a practical understanding of organizations, processes, strategy, risk and risk management and the methods to drive change and growth. Through their service as top leaders at other organizations, they also bring valued perspectives on common issues affecting other companies and Phillips 66.•Financial reporting experience. An understanding of finance and financial reporting processes is important. The Company measures its operating and strategic performance by reference to financial targets. In addition, accurate financial reporting and robust auditing are critical to the Company's success. We seek to have multiple directors who qualify as audit committee financial experts, and we expect all of our directors to be financially knowledgeable.•Industry experience. Directors with experience as executives or directors or in other leadership positions in the energy industry bring pertinent background and knowledge to the Board. These directors have valuable perspective on issues specific to the Company's business.•Global experience. As a global company, directors with global business or international experience provide valuable perspectives on our operations.•Environmental experience. The perspective of directors who have experience within the environmental regulatory field is valued as we implement policies and conduct operations in order to ensure that our actions today will provide the energy needed to drive economic growth and social well-being, while also securing a stable and healthy environment for tomorrow.•Risk management experience. Directors with experience as executives managing risk provide insight and guidance that enhance the Board's capabilities in performing its risk oversight responsibilities.MR.ADAMSMR.FERGUSONMR.GARLANDMR.LOOMISMR.LOWEMR.MCGRAWMS.RAMOSMR.TILTONMS.TSCHINKELDR.WHITTINGTON CEO ExperienceüüüüüüüüFinancial Reporting ExperienceüüüüüüüüüüIndustry ExperienceüüüüüüüGlobal ExperienceüüüüüüüüüüEnvironmental ExperienceüüüüüüüüüRisk Management Experienceüüüüüüüüüü ![[MISSING IMAGE: ph_gary-adams02.jpg]](https://capedge.com/proxy/PRE 14A/0001144204-18-014335/ph_gary-adams02.jpg)

![[MISSING IMAGE: ph_john-lowe02.jpg]](https://capedge.com/proxy/PRE 14A/0001144204-18-014335/ph_john-lowe02.jpg)

Director since April 2012 ![[MISSING IMAGE: ph_denise-ramos02.jpg]](https://capedge.com/proxy/PRE 14A/0001144204-18-014335/ph_denise-ramos02.jpg)

The lack of a "ü" for a particular item does not mean that the director does not possess that qualification, characteristic, skill or experience. We look to each director to be knowledgeable in these areas; however, the "ü" indicates that the item is a specific qualification, characteristic, skill or experience that the director brings to the Board.2017 PROXY STATEMENT 21PROPOSAL 1: ElectionMs. Ramos served on the board of DirectorsPraxair, Inc. from 2014 to 2016. She serves on the board of trustees for the Manufacturers Alliance for Productivity and Innovation, and is a member of the Business Council. Committeesthe BoardCOMMITTEECURRENT MEMBERSPRINCIPAL FUNCTIONSNUMBER OFMEETINGSIN 2016 Audit and FinanceJ. Brian Ferguson*(1)![[MISSING IMAGE: ph_william-loomis02.jpg]](https://capedge.com/proxy/PRE 14A/0001144204-18-014335/ph_william-loomis02.jpg)

(1)John E. Lowe(1)Denise L. Ramos(1)Victoria J. Tschinkel

Discusses, with management,independent auditorsCEO of Lazard LLC from 2000 to 2001 and the internal auditors, the integritya Limited Managing Director of Lazard LLC from 2002 to 2004. Mr. Loomis served as a director of L Brands Inc. from 2005 to 2016. ![[MISSING IMAGE: ph_glenn-tilton02.jpg]](https://capedge.com/proxy/PRE 14A/0001144204-18-014335/ph_glenn-tilton02.jpg)

Company's accounting policies, internal controls, financial statements,Midwest of JPMorgan Chase & Co. from 2011 to 2014. From 2002 to 2010, he served as Chairman, President and financial reporting practices,CEO of UAL Corporation, a holding company, and select financial matters, covering the Company's capital structure, complex financial transactions, financial risk management, retirement plansUnited Air Lines, Inc., an air transportation company and tax planning.Reviews significant corporate risk exposureswholly-owned subsidiary of UAL Corporation. Mr. Tilton previously spent more than 30 years in increasingly senior roles with Texaco Inc., including Chairman and steps management has taken to monitor, control and report such exposures.Monitors the qualifications, independence and performance of our independent auditors and internal auditors.Monitors our compliance with legal and regulatory requirements and corporate governance guidelines, including our Code of Business Ethics and Conduct.Maintains open and direct lines of communication with the Board and our management, internal auditors and independent auditors.11ExecutiveGreg C. Garland*J. Brian FergusonWilliam R. Loomis, Jr.John E. LoweGlenn F. TiltonMarna C. WhittingtonExercises the authority of the full Board between Board meetings on all matters other than (1) those expressly delegated to another committeeCEO in 2001. He served as Non-Executive Chairman of the Board (2)of United Continental Holdings Inc. from 2010 to 2013 and currently serves on the adoption, amendment or repealboards of anyAbbott Laboratories and AbbVie Inc. (as lead director).our By-Lawsexperience in the energy industry and (3) those that cannot be delegated to a committee under statute or our Certificate of Incorporation or By-Laws.expertise in finance and capital markets matters. —Human Resources and CompensationMarna C. Whittington*Gary K. AdamsHarold W. McGraw IIIGlenn F. TiltonOversees our executive compensation policies, plans, programs and practices.Assists the Board in discharging its responsibilities relating to the fair and competitive compensation of our executives and other key employees.Reviews at least annually the performance (together with the Lead Director) and sets the compensation of the CEO.6Nominating and GovernanceWilliam R. Loomis, Jr.*J. Brian FergusonDenise L. Ramos![[MISSING IMAGE: ph_marna-whittington02.jpg]](https://capedge.com/proxy/PRE 14A/0001144204-18-014335/ph_marna-whittington02.jpg)

Selects and recommends director candidates to the Board to be submitted for election at Annual Meetings and to fill any vacancies on the Board.Recommends committee assignments to the Board.Reviews and recommends to the Board compensation and benefits policies for our non-employee Directors.Reviews and recommends to the Board appropriate corporate governance policies and procedures for our Company.Conducts an annual assessment of the qualifications and performance of the Board.Reviews and reports to the Board annually on succession planning for the CEO.3Public PolicyJohn E. Lowe*Gary K. AdamsJ. Brian FergusonWilliam R. Loomis, Jr.Harold W. McGraw IIIDenise L. RamosGlenn F. TiltonVictoria J. TschinkelMarna C. WhittingtonAdvises the Board on current and emerging domestic and international public policy issues.Assists the Board with the development, review and approval of policies and budgets for charitable and political contributions and activity.Advises the Board on compliance with policies, programs and practices regarding health, safety and environmental protection.6 *Committee Chairperson(1)Audit committee financial expert22 2017ContentsCompany'sCompany’s financial statements. The Audit Committee has appointed Ernst & Young LLP to serve as the Company'sCompany’s independent registered public accounting firm for fiscal year 2017.2018. Ernst & Young has been retainedacted as the Company'sCompany’s independent registered public accounting firm continuously since 2012.Company'sCompany’s independent auditors prior to the firm'sfirm’s engagement, and periodically considers whether a regular rotation of the independent auditors is necessary to assure continuing independence. The Audit Committee and its Chairman are directly involved in the selection of Ernst & Young'sYoung’s lead engagement partner."FOR"“FOR” THE PROPOSAL TO RATIFY THE APPOINTMENT OF ERNST & YOUNG LLP.Company'sCompany’s independent registered public accounting firm. Even if the selection is ratified, the Audit Committee may in its discretion select a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its shareholders.20162017 included an audit of our consolidated financial statements, an audit of the effectiveness of the Company'sCompany’s internal control over financial reporting, and services related to periodic filings made with the SEC. Additionally, Ernst & Young provided certain other services as described below. In connection with the audit of the 20162017 consolidated financial statements, we entered into an engagement agreement with Ernst & Young that set forth the terms by which Ernst & Young performed audit services for us.Young'sYoung’s fees for professional services totaled $12.8 million for 2017 and $14.5 million for 2016, and $12.9 million for 2015, which consisted of the following: Fees (in millions) Audit Fees(1) $11.8 $13.5 Audit-Related Fees(2) 0.6 0.6 Tax Fees(3) 0.2 0.2 All Other Fees 0.2 0.2 Total $12.8 $14.5 Fees (in millions) 2016 2015 $ 13.5 $ 11.8 0.6 0.7 0.2 0.2 0.2 0.2 $ 14.5 $ 12.9 (1)$1.3 million for 2016, and 2015, respectively, which were approved by the Audit Committee of the General Partner of Phillips 66 Partners LP.(2)(3)Young'sYoung’s independence is not impaired; (b) describes the audit, audit-related, tax and other services that may be provided and the non-audit services that are prohibited; and (c) sets forth pre-approval requirements2017 PROXY STATEMENT 23PROPOSAL 2: Ratification of the Appointment of Ernst & Young LLPthe shareholders.Directors.directors. The Board has determined that each member of the Audit Committee satisfies the requirements of the NYSE as to independence, financial literacy and expertise. The Board has further determined that each of J. Brian Ferguson, William R. Loomis, Jr., John E. Lowe, and Denise L. Ramos is an audit committee financial expert as defined by the SEC. The responsibilities of the Audit Committee are set forth in the written charter adopted by the Board of Directors, which is available in the "“InvestorsInvestors"” section of the Company'sCompany’s website under the caption "“Corporate GovernanceGovernance."” One of the Audit Committee'sCommittee’s primary responsibilities is to assist the Board in its oversight of the integrity of the Company'sCompany’s financial statements. The following report summarizes certain of the Audit Committee'sCommittee’s activities in this regard for 2016.Company'sCompany’s Annual Report on Form 10-K for the year ended December 31, 2016,2017, and management'smanagement’s assessment of the effectiveness of the Company'sCompany’s internal control over financial reporting as of December 31, 2016,2017, included therein.No.1301No. 1301 as adopted by the Public Company Accounting Oversight Board. The Audit Committee has received the written disclosures and the letter from Ernst & Young required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant'saccountant’s communications with the Audit Committee concerning independence, and has discussed with that firm its independence from Phillips 66.Company'sCompany’s Annual Report on Form 10-K for the year ended December 31, 2016.2017.

William R. Loomis, Jr.

John E. Lowe

Denise L. Ramos